There is a careful optimism regarding a return of more vivid activity in the ships’ demolition market, despite a lacklustre start to the new year. In its latest weekly report, Clarkson Platou Hellas said that “it would appear that the holiday season has continued into 2019 as this year has begun in a very subdued manner with little demand or activity to report. The lack of demand from the recyclers is of some concern at this present time as it is becoming increasingly difficult for an offer to be obtained for any new vessel in the market or for cash buyers with tonnage in their hands for a potential resale – this is the worrying issue from cash buyers”. The shipbroker added that “this slow start was expected, based on the run up to the holiday season, and it seems we could be in for a stagnated period for the forthcoming weeks. We therefore may only know the true market conditions when all offices re-open again and people return to their desks and are ready to register firm offers again. Looking back over the year for 2018, it has been one of development as we have seen the first H.K. Convention compliant yard established in Bangladesh, certified by Rina Class, due to the innovation made by the PHP family, who believe will start to become more competitive this year to compete against its Indian counterparts. However, the Indian recyclers have not paused in this aspect in making major improvements to their yards, and much praise must also be aimed at them too for their achievements as now, over 76 yards are classified as compliant in conjunction with the H.K. Convention. In addition, there is further hope that one or two leading yards in Alang will be ratified under the EU regulation list for ship recycling for recognition as safe and responsible places to recycle vessels. Time will tell whether the beaching process can be approved for such a move. Two yards in Turkey, operated by the Leyal Group, and one in U.S.A. were the first non-European ship recycling facilities to join the EU List of approved ship recycling facilities under the new European Ship Recycling Regulation and therefore let us hope the Indian recyclers are rewarded for the effort and financial input by also receiving such approvals by the EU. We must congratulate all of the transformations made last year by recyclers and hope that this year proves to be even more prosperous as certainly, last year saw more emphasis on Green ship recycling. With the EU Ship recycling regulation now in place (i.e. European flagged units can only be recycled at E.U. Ship Recycling approved yards), it will be interesting to see how ship owners react to this new legislation”, Clarkson Platou Hellas concluded.

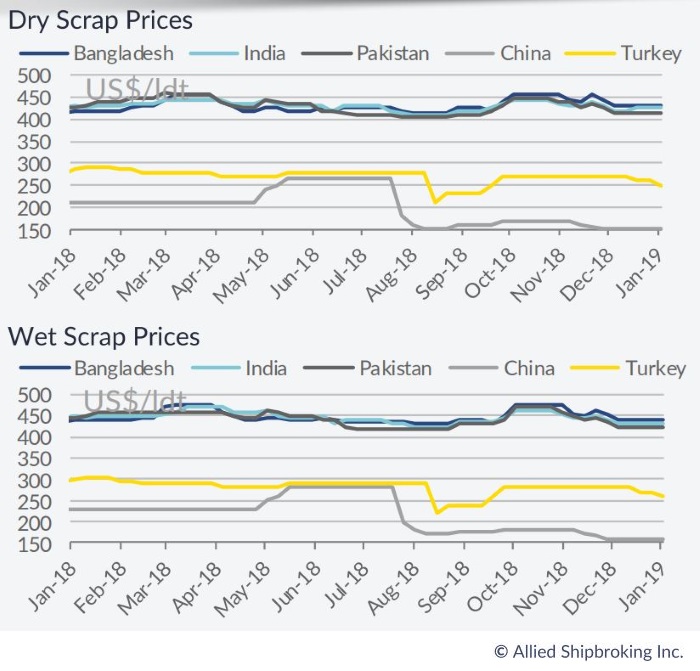

In a separate note, Allied Shipbroking said that “activity in the demolition market ramped up in the first week of the year, with several vessels being sent to the breakers. Several containerships and offshore vessels were sent for demolition during the week. On the other hand, activity was subdued on the dry bulk side, with only one 20 years old Japanese Cape being scrapped. At the same time, 3 vintage tankers were being recycled. With activity at healthy levels in the last couple of weeks in 2018, it is no surprise that this year has started on a slow note for the dry bulk and the tanker segments. With regard to scrapping destinations, optimism has remained strong from Bangladeshi breakers, with political stability in the country playing an important role there. Meanwhile, competition from other scrapping destinations is a bit sluggish right now, as local steel prices in India and Pakistan have moved downward as of late, making them less competitive for the time being. Moreover, it is worth mentioning that according to the EU Ship Recycling Regulation, from this year, large commercial seagoing vessels with an EU flag can only be recycled in one of the approved recycling facilities. Currently this list contains 26 scrapyards, 23 within the EU, 2 in Turkey and 1 in the US”.

Meanwhile, in its latest weekly report, GMS, the world’s largest cash buyer said that “after a slightly sluggish festive period (in terms of sentiment and pricing) and as the industry head into the New Year, there was brewing optimism for a return to form in the subcontinent ship recycling markets. Bangladeshi elections have finally concluded (on the 30th of December) and as expected, it was a resounding victory for the ruling party with no change to the regime reported. This in turn (is hoped) will quell some of the ongoing political unrest and uncertainty that have pervaded the country of late. Pakistan – starved of tonnage – may also come back into the picture as the currency seems to have finally settled and high-rise building projects resume this year, leading to an increased demand for steel products. Having missed out on many of their favored container units of late, India too is likely to get back to the buying as local recyclers shift their focus towards and remain keen to import many of the green and offshore units on offer. China of course has closed as a viable destination for international tonnage from the start of this year and only 1 – 2 of the open yards have the necessary licenses and the ability to import Chinese flagged vessels, albeit at rock bottom prices that remain frustrated in the low USD 100s/LDT (even emerging South East Asian yards are paying more at present). The Turkish market remains lost as local fundamentals further displayed volatility this week and local Buyers refrain from any aggressive moves whilst local levels continue to dither. Finally, the EU ship recycling regulations are now in full force, which states that EU flagged ships can only go to EU approved facilities, almost all of which are in Europe and only 2 yards approved in Turkey. Moreover, 13 yards in India have also applied for approval; however, this is expected to be a slow moving process and the timeline for Indian approvals remains foggy at best. For further information / clarification on the new regulations, please contact one of our local offices” GMS concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

|