Despite the Festive period in a large part of the world, activity in the demolition market has remained in high levels. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “a correction downwards in price levels is clearly evident this week with the majority of Buyers providing some reluctance to offer for any available unit until the turn of the year. As such, many Owners have decided to withdraw any proposed tonnage from the market and therefore, the lack of sales looks set to continue into the New Year when all parties can digest the market conditions on the arrival of 2019. Certainly, on the back of reducing rates, new ships being offered to the market remain scarce which is giving a general quiet period as we enter the Christmas season. The uncertainty on the waterfront is such that those cash buyers with tonnage in hand are reportedly having to suffer the consequences and selling those vessels at a loss as the fear is that the market could fall further. Let us hope 2019 brings some stability and a positive spirit back into the market place. In summarizing and prior to the Christmas holidays, the recycling market remains soft and, currently, uninspiring. How the year ends, and the new year begins, depends primarily on several factors including the supply of tonnage, but equally, the demand from the recyclers, currency fluctuations, Chinese steel prices which could have an effect on domestic steel prices and the ‘post-election’ mood in Bangladesh”.

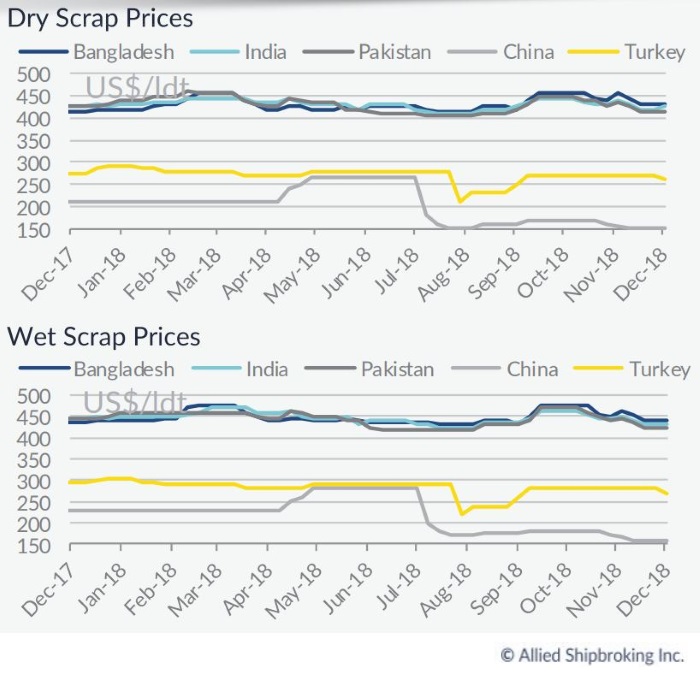

In a separate note, Allied Shipbroking added that it was “another week with activity remaining at low levels in terms of dry bulk tonnage. The slightly improvement in sentiment among owners sourced by the improved freight rates seen in the last couple of months have diminished the interest for early retirement of tonnage. However, the first months of 2019 will determine the direction that owners will follow in the near-term. On the tankers’ side, some in-creased activity was witnessed this past week, despite that we are in the last week before the Christmas holiday lull officially takes hold. All the tankers sold for demolition this past week were built between 1999 and 2003. In the rest of sectors, activity remained at satisfactory levels. As to scrapping destinations, declining steel prices and local currency exchange rates in India has pushed for declined interest amongst cash buyers, affecting market share of domestic breakers. Meanwhile, Bangladesh remained the most stable scrapping market for the moment, with demand from cash buyers still on an upward momentum. In Pakistan and Turkey, market conditions right now do not facilitate for any major competitive push from local breakers there”, said Allied.

Meanwhile, in a separate report, GMS, the world’s leading cash buyer of ships said that “the traditional year-end exuberance from the subcontinent markets has yet to officially materialize, given the ongoing uncertainty with local fundamentals that has ensured prices and demand remain relatively subdued. Levels across the board have cooled off by about USD 25 – USD 30/LDT in these final months of 2018 and several Cash Buyers have been caught off-guard with their recently acquired high-priced, large LDT (still unsold) inventory (particularly, Capes, Afras and Suezmax tankers in particular). Making matters more challenging for them have been the ongoing L/C issues in both India & Bangladesh that now seem to be infecting Pakistan (albeit in a different manner) and depending on the subcontinent location, this has resulted in delays / restrictions in opening fresh LCs. As such, smaller LDT ships with shorter recycling times have increasingly taken priority of late. Meanwhile, elections in Bangladesh on December 30th have resulted in a virtual halt to domestic new building projects and most end Buyers have subsequently decided to wait and watch the outcome of the elections (despite no upheaval or change of government expected) before committing on fresh units. Pakistan remains a concern, with levels really struggling to replicate the form from earlier in the year, despite the recent resumption of high rise building projects and an increased demand for steel. Indian Buyers remain nervous about the ongoing volatility of their local fundamentals, picking and choosing which units to bid on and at what price. Finally, as China gears up to disappear from the scene, the Turkish market continues to dither with a weakening local steel plate price and declining offerings on ships. Overall, the supply of ships going into the festive period remains steady – particularly on containers & tankers – and despite the festivities and holidays that are soon approaching, Cash Buyers & end Buyers are likely to remain busy through the turn of the year”, GMS concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

|